How Much Salary Spend on Car Malaysia

It says that your total auto budget including fuel insurance and maintenance should not exceed 22 percent of your take-home pay. Car Sales Executive salary in Malaysia How much does a Car Sales Executive make in Malaysia.

Top 7 Reasons Malaysians Should Not Work In Singapore Because Of Higher Salaries In 2019 By Mc Wong Medium

For those with a salary near 30000 your home car and debt combine should be no more than 1250 per month.

. The average salary for a car sales executive is RM 3327 per month in Malaysia. With a 100000 salary you could afford a mortgage payment of no more than 2500. So yeah most Malaysians are generally living beyond their means and does not consider saving for rainy days.

130 salaries reported updated at 5 August 2022. How much should I spend on a car based on salary. How much should I spend on a car if I make 60000.

Average Monthly Salary 4300 MYR 51600 MYR yearly LOW 1960 MYR AVERAGE 4300 MYR HIGH 12300 MYR A person working in Automotive in Malaysia typically earns around 4300 MYR per month. When applying for a loan banks will only allow you to borrow up to a certain amount of your DSR. In general experts recommend spending 1015 of your income on transportation including car payment insurance and fuel.

200 300 recommended maximum 10 percent minus 100 for auto insurance Car loan term. Malaysians spent the most on fish and seafood at RM169 per month comprising 37. In 2021 the average car costs 42258 with an average payment of 563 per month according to data from Kelley Blue Book and LendingTree.

NerdWallet recommends spending no more than 10 of your take-home pay on your monthly auto loan payment. I was driving and holding my phone to update my Waze destination a police traffic car stopped me. That makes your total monthly budget in this example 777.

RM 3327 per month. The officer took picture of my car and printed the saman. That means that if you earn 36000 a year the automobile shouldnt cost more than 12600 to purchase.

I buat-buat bodoh and said its unfortunate but what to do. Lets look at an example of how the 20410 rule works if you have a monthly income of 3000 and spend 100 a month on car insurance and are trying to figure out how much vehicle you can afford. This however is subjective as each bank has different requirements so its best to check with.

Total monthly commitments. Ideally if you want to drive a RM26000000 car comfortably then you should at least generate RM13300000 annual income which translates to about RM1100000 monthly salary this figure is net by the way. To find how much car you can afford you need to first calculate the amount you can pay as your car loan emi.

You should not spend more than 35 percent of your total yearly income on automobiles regardless of whether you are paying cash leasing or financing a new vehicle. How much does the average person spend on buying a car. He kept insinuating that are you sure you want to spend time going to mahkamah.

Free Malaysia Today FMT 296 C. The average price of car insurance based on the top 10 insurers in the country is 3953 per year or about 329 per month. Salaries range from 1960 MYR lowest average to 12300 MYR highest average actual maximum salary is higher.

The car loan amount you avail will be the actual car. For example if your take-home pay is 4000 per month then you. Down payment you are willing to pay in at the time of vehicle purchase.

The calculator here will help you find the amount you can spend on a car based on your salary and expenses. Beyond the sticker price and payments however there are the costs of gas insurance oil changes and other expenses car owners need to consider. RM500 car loan RM200 PTPTN RM300 credit card RM1000.

Average base salary Data source tooltip for average base salary. Though there is no fixed cost as it depends on the car age model and make as well as mileage but a car that has driven 50000km to 80000km could cost at least RM1500 from our rough estimate based on personal experience and research. RM1000 RM4500 x 100 22.

So if your after-tax pay each month is 3000 you could afford a 300 car payment. Households spent RM783 a month on food and drinks in 2019 encompassing 173 of total spending. So theoretically if your salary is 50000 you could afford a car payment of 430 or less.

How Much Can I Afford To Buy A House In Malaysia New Property Nuprop

How Much Can I Afford To Buy A House In Malaysia New Property Nuprop

Your Electric Car May Or May Not Save You Money

How Much Can I Afford To Buy A House In Malaysia New Property Nuprop

How Much Do You Need To Earn Before You Even Think Of Buying A Car In Singapore

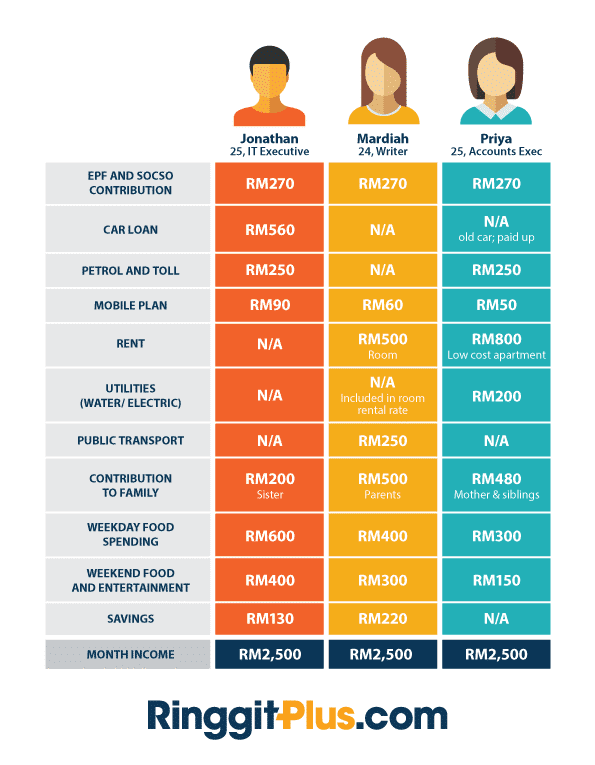

Rm2 500 Fresh Grad Salary Why It S Not A Question Of Enough

0 Response to "How Much Salary Spend on Car Malaysia"

Post a Comment